Our Services

We enable to facilitate the drift of finance from suitable capital providers. We provide debt finance solutions through impelling and resilient strategies that empower the growth and success of our clients. We ensure the transactions we undertake meet the needs of our client and as well meets the need of the lenders. We provide all relevant information and present them in a structured format, thereby helping the lenders to make an informed decision.

Services

Project Financing

Project financing for greenfield or brownfield projects, asset financing, external commercial borrowing, foreign currency term loans, construction finance for real estate, acquisition finance, securitization, other structured products.

Working Capital Finance

All types of fund based & Non - fund based facilities to meet the working capital requirement.

Trade Finance

Supply Chain Finance, Vendor Finance, Bill discounting, Post Shipment Finance, etc.

Debt Advisory

Debt Servicing, Lender / Investor Compliance, Negotiations on terms and conditions etc

Consortium Management

Keeping all bankers in tune is an integral part of any company enjoying credit facilities under consortium arrangement. We make sure that the client expectations are met well through all the consortium members.

Credit Rating Advisory

Credit rating is an important parameter that derives the terms and conditions of any corporate. We ensure the company is rated well & it enhances over a period of time to commensurate with its growth.

Private Funding or Wealth Management Services

We have access to HNIs who lend their funds for short term. With this service, corporates get timely support in case of a short term liquidity mismatch.

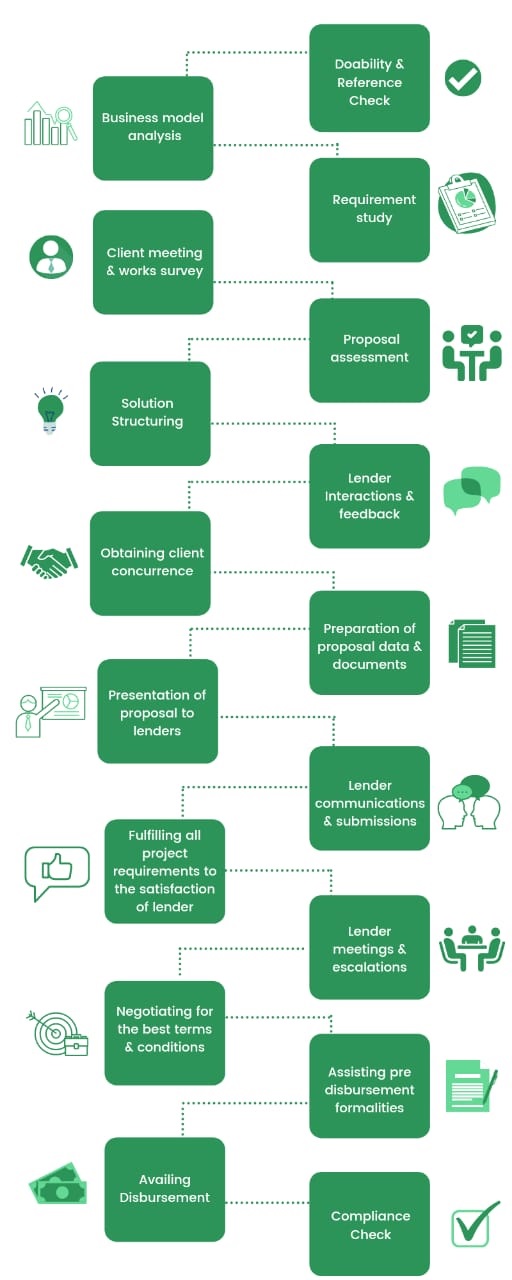

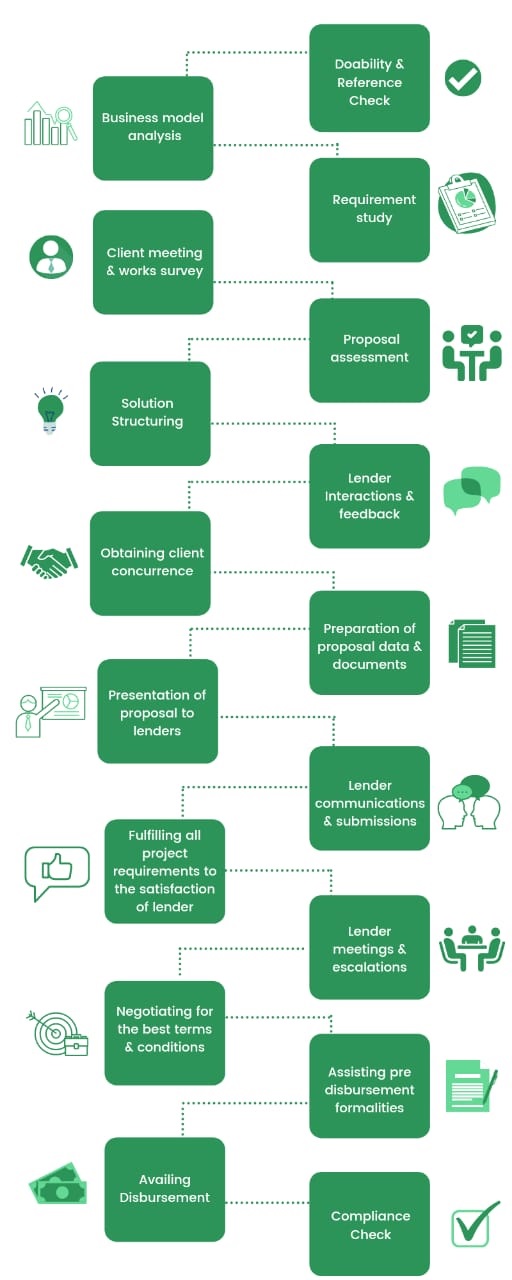

Process Flow

We comply, handhold and run the end to end debt raising process. We manage through the entire process and arrange on final results. This assists our corporate clients to focus on their core business.

Doability & Reference Check

Business model analysis

Requirement study

Client meeting & works survey

Proposal assessment

Solution Structuring

Lender Interactions & feedback

Obtaining client concurrence

Preparation of proposal data & documents

Presentation of proposal to lenders

Lender communications & submissions

Fulfilling all project requirements to the satisfaction of lender

Lender meetings & escalations

Negotiating for the best terms & conditions

Assisting pre disbursement formalities

Availing Disbursement

Complaince Check

Doability & Reference Check

Business model analysis

Client meeting & works survey

Requirement study

Proposal assessment

Solution Structuring